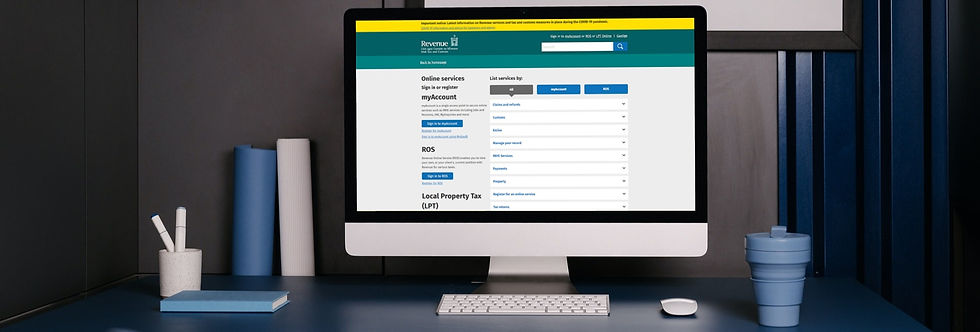

Revenue online services Course

Learn how to use ROS to its full potential

Aim of course

This course is ideal for anyone who is currently registered or plan to register with ROS. Also for anyone who has the responsibility for communicating with Revenue on ROS.

Who should attend

Employers, business owners, bookkeepers & administrators and anyone responsible for communicating with Revenue.

Benefits of attending

Participants will benefit from live demonstrations on how to navigate ROS. All participants will have access to a resource platform with additional resources and supports.

What is covered ?

-

Benefits of ROS & how to access ROS.

-

Demonstrate the 3 steps to becoming a ROS Customer.

-

How to register for Income Tax.

-

Filing returns online & offline using ROS.

-

Demonstration of filing online returns.

-

Return preparation facility on ROS.

-

Downloading and completing ROS forms offline.

-

Setting up bank details for payments & refunds.

-

Explain the different methods of payment.

-

Using the Inbox facility.

-

My enquiries with ROS

-

Apply for Tax clearance cert on ROS.

Benefits of attending this online course

-

Self-paced learning option, at a time and place that suits you.

-

Course delivered by a qualified account with 20 plus years’ experience.

-

Access to 1 x 3-hour recordings which includes demos on navigating ROS.

-

Access to additional online resources to include bite size recordings to address FAQ

-

Access course content for 1 year from the date of registration.

-

Course content & resources are updated frequently to ensure its accurate and relevant.

-

Download Certificate of Completion

_edited.jpg)